- #Irs 2016 extension form 4868 instructions pdf

- #Irs 2016 extension form 4868 instructions full

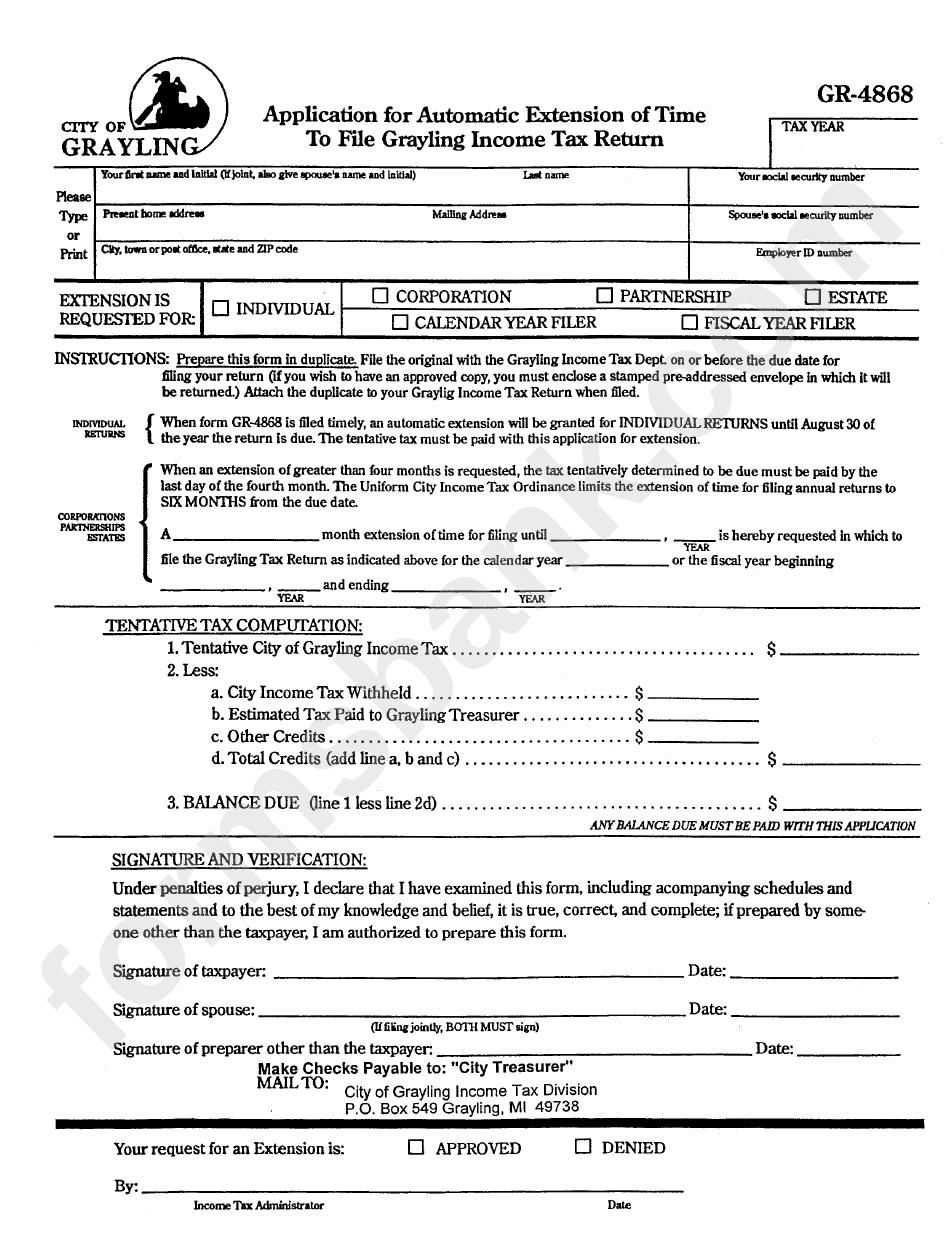

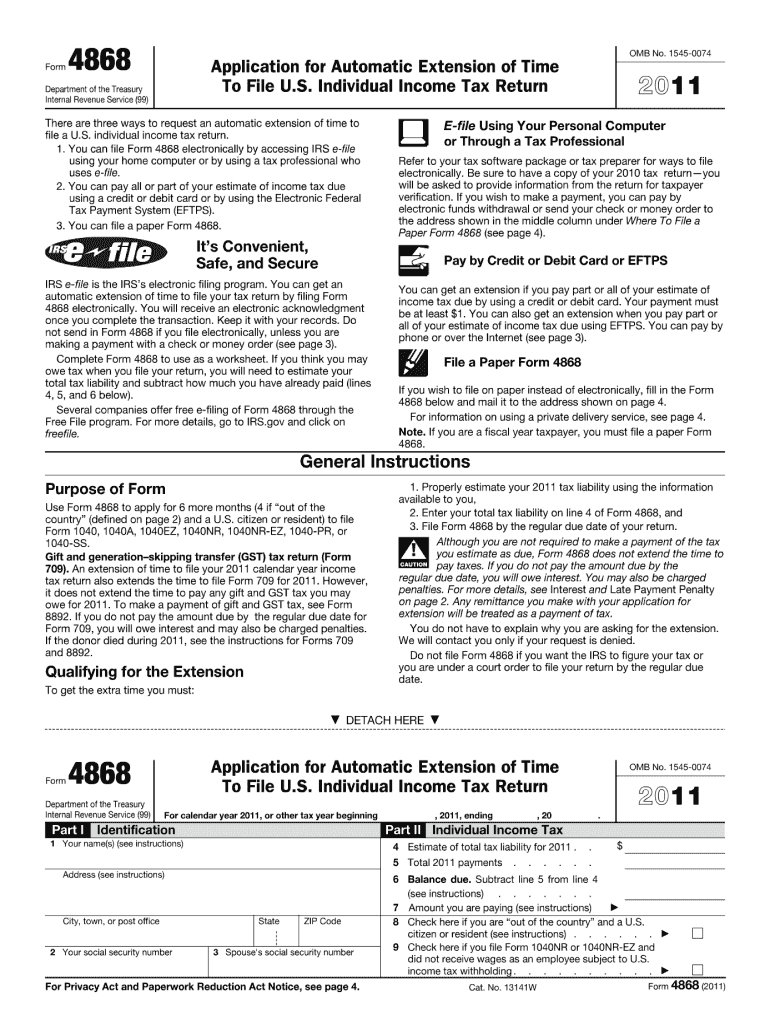

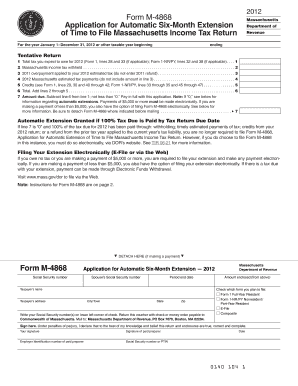

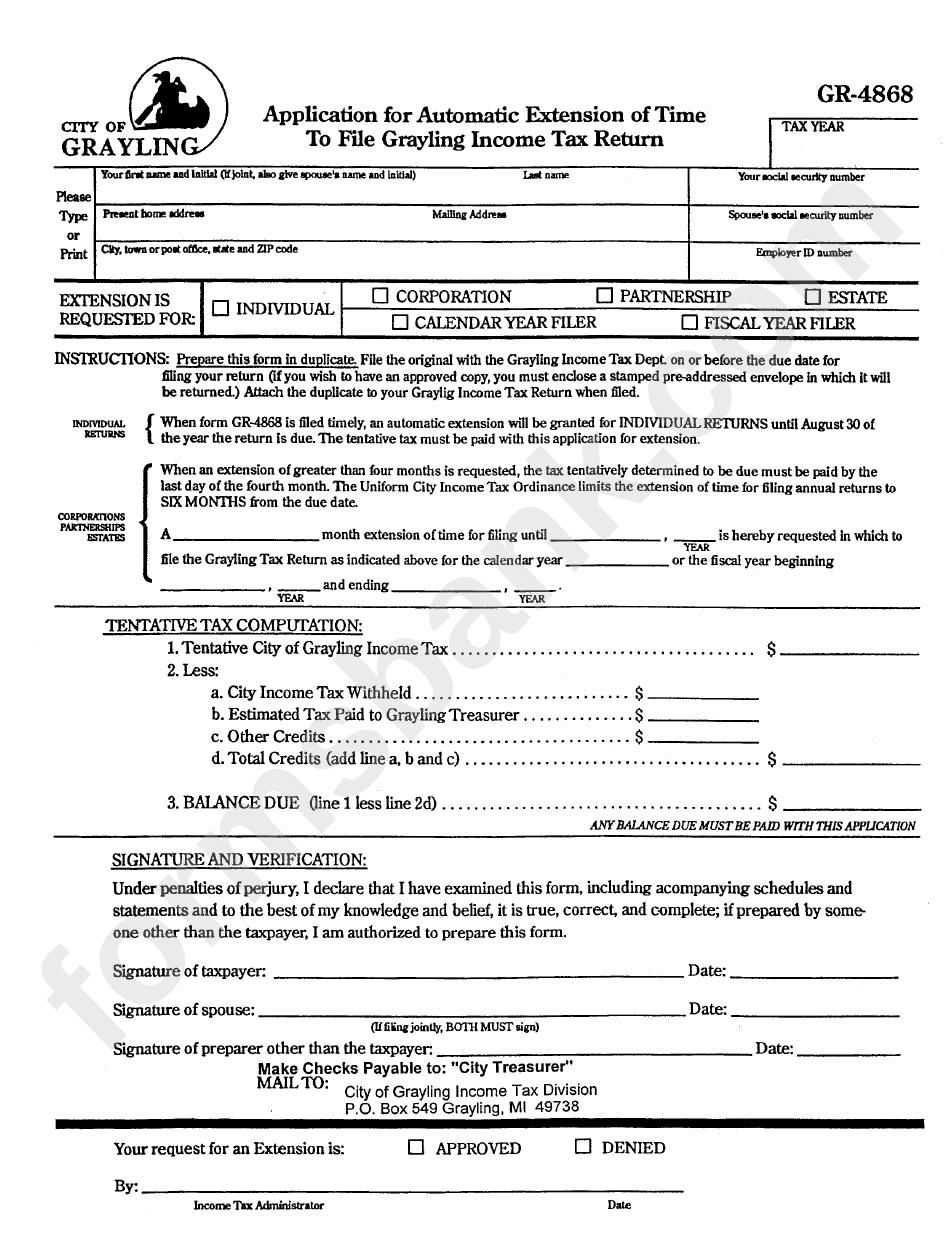

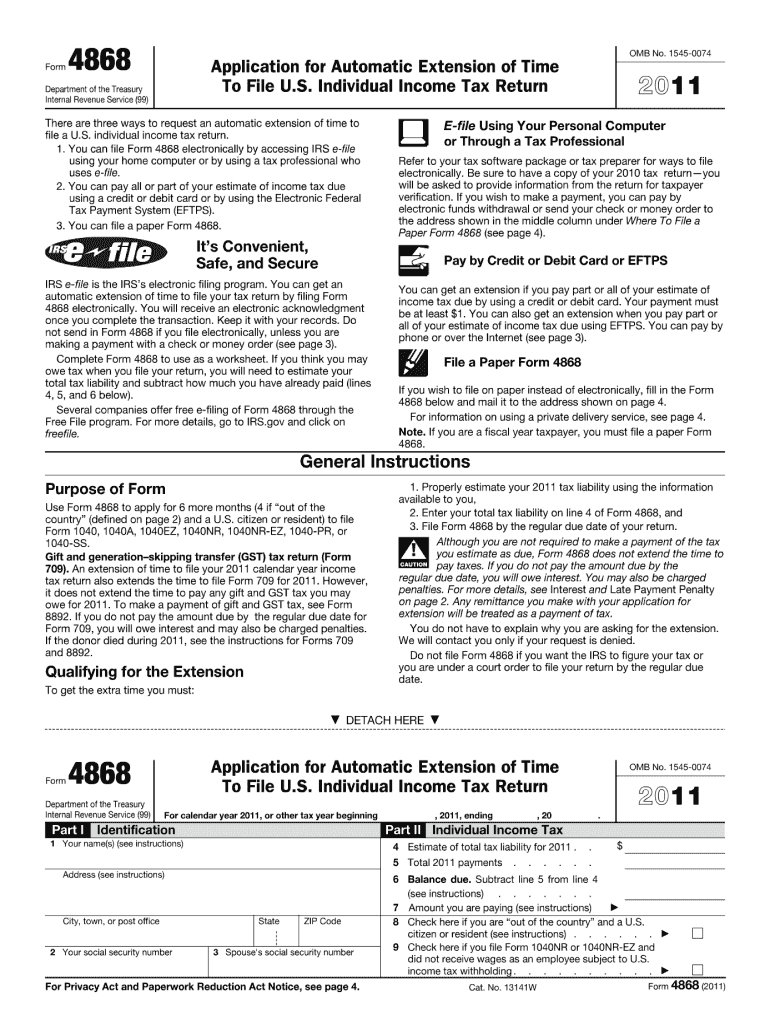

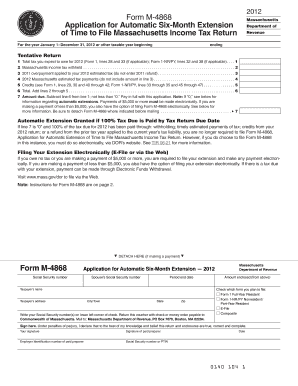

If you fail to pay any taxes by April 15, you will be subject to interest payments regardless of whether you qualify for an extension or not. The rest of the form’s pages are specific instructions for filing. That’s the only information you will need to record on the form. If you’re a United States citizen or permanent green card holder, but you’re currently outside the country, you should check the box that notes this. Then, note what amount you’re paying with the form. Subtract the total payments from your total liability to find out what balance is due. You will need to estimate the tax liability you have for the fiscal year, along with the total payments you’ve made. Part II will have you calculate and record your individual income tax.

This includes your full name, current address, Social Security number, and the Social Security number of your spouse.

In Part I, you’ll be asked to give basic identifying information. Failing to file your tax return by this point could result in you being subject to fees and other penalties from the IRS. Your tax return’s due date will remain April 15. If you don’t file this form within the specified time period, you won’t be able to extend the due date for your tax return. What Are the Consequences for Not Using a 2016 Form 4868 PDF?

The specific PDF listed here is for the 2016 tax year, but Form 4868 in general can be used to extend the tax return due dates in the appropriate tax year. This form should be used by anybody who wishes to have their tax return due date extended. When Should a 2016 Form 4868 PDF Be Used? You will need to give an estimated payment of your tax due if you owe any taxes. Again, you can’t use this form to file an extension on your payment. Sole proprietors who file with Schedule CĪnybody who meets these criteria and wishes to extend their tax return filing should use Form 4868.Limited liability corporations that are only owned by one person.

Any contractor who has issued any kind of 1099. Any taxpayer who is required to file any kind of 1040. The following types of people are eligible to use a Form 4868: People are eligible to make corrections to their requests for a tax extension, as long as they file those requests within a predetermined time period. You might also opt to pay none of your taxes through this method and instead give payment in another form. It’s possible to pay a portion or all of your taxes through an Electronic Funds Transfer, which will take the money directly out of your relevant bank account. When you complete the application for an extension, you will need to provide an estimate of the taxes you have due. If you owe any taxes, rather than getting a return, these tax payments will still be due on April 15 whether you file a Form 4868 or not. With all of this said, you should be aware that you cannot extend the time limit for paying taxes. If you file for an extension, your tax deadline will be extended to October 15 for these types of tax returns:įill Out Your 2016 4868 PDF with PDFSimpli in Seconds! Also included are Sole Proprietors defined under Schedule C. It includes any taxpayer who files a 1040, any contractor who files a 1099, and limited liability corporations with only one member. This means people who are filing their individual tax return for their income. What Is a 2016 Form 4868 PDF Used For?įorm 4868 is used as a tax extension form for people who are giving the IRS income reports. This form must be filed by the original due date for your tax return, which is usually April 15. When this is the case, you’ll fill out and file a Form 4868. If you find yourself unable to file your federal tax return before the due date arrives, you might be eligible to receive a 6-month extension of the time you have to file. 7.3 When will you know if your request was approved?. 7.2 Can an extension last longer than 6 months?. 7.1 What if you’ll be getting a tax return rather than paying taxes?. 5 What Are the Consequences for Not Using a 2016 Form 4868 PDF?. 4 When Should a 2016 Form 4868 PDF Be Used?. 2 What Is a 2016 Form 4868 PDF Used For?. 1 Facts about the 2016 4868 PDF template.

0 kommentar(er)

0 kommentar(er)